On January 10, 2025, the Federal Trade Commission (FTC) released increased jurisdictional thresholds, filing fee thresholds, and filing fee amounts for merger notifications made pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act).

Merger Notification Threshold Changes

The HSR premerger notification regime requires transacting parties to notify the FTC and US Department of Justice (DOJ) of their intent to consummate a transaction that meets or exceeds certain jurisdictional thresholds, unless an exemption applies. The adjusted thresholds apply to all transactions that close on or after the effective date, which will be 30 days after the notice is published in the Federal Register.

The HSR thresholds are adjusted annually based on gross national product (GNP). The threshold changes are as follows:

- The base statutory size-of-transaction threshold, the lowest threshold requiring notification, will increase to $126.4 million.

- The upper statutory size-of-transaction test, requiring notification for all transactions that exceed the threshold (regardless of the size-of-person test being satisfied), will increase to $505.8 million.

- The statutory size-of-person lower and upper thresholds (which will apply to deals valued above $126.4 million but not above $505.8 million) will increase to $25.3 million and $252.9 million, respectively.

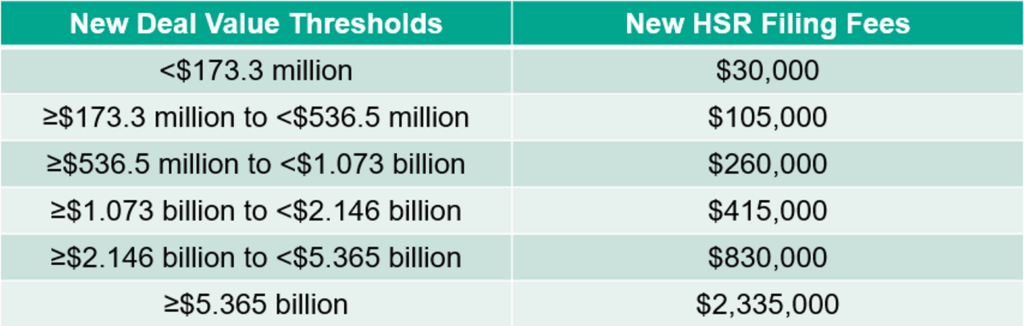

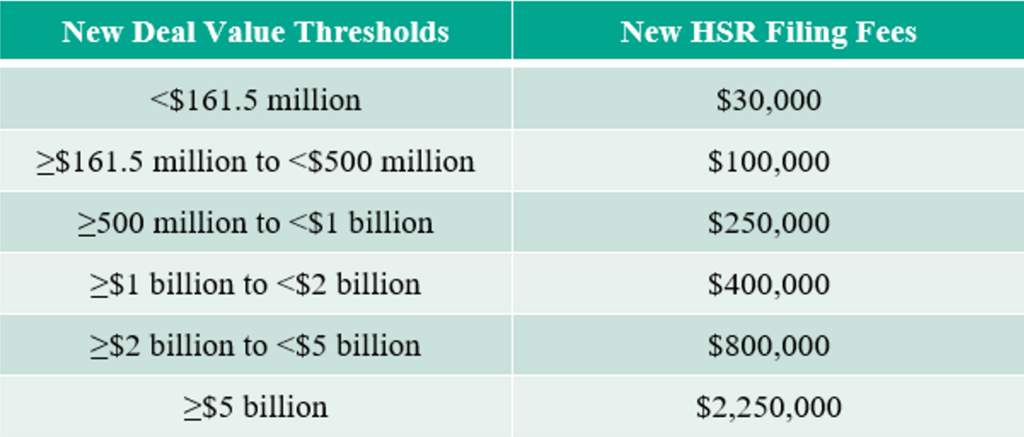

HSR Filing Fee Changes

The FTC is also required to update filing fee thresholds and amounts on an annual basis. Filing fee thresholds are adjusted based on the percentage change in GNP and filing fee amounts are adjusted based on the percentage change in the Consumer Price Index. These changes will also take effect 30 days after publication of the notice in the Federal Register.

The adjusted filing fee thresholds and fee amounts are provided in the table below.

read more

Subscribe

Subscribe